Transferring cash between a standard IRA and gold IRA without having incurring taxes or penalties is named a rollover, so be careful that any transaction in between custodians happens directly without you getting possession. Otherwise, the IRS could take into account your transaction a distribution matter to taxes and penalties.

A gold IRA can be a sort of person retirement account that's funded with physical gold and other precious metals in the form of bullion, coins, or bars. As you could know, gold is kind of precious so you will need to make certain that you choose the best gold IRA organization.

Have a verifiable background of consumer pleasure, Through 3rd party testimonials, but it is necessary to be sure that Individuals providing an belief are verifiable shoppers and not merely paid shills. (TrustLink and copyright are examples of respected 3rd party sector reviewers).

To be a retirement investment option, a gold IRA rollover is thus an outstanding decision. Though it will not likely automatically give the very best amount of return, it is among the finest tips on how to preserve the worth of the retirement investments.

To give you a head commence with your study, let's Have a look at the best gold investment companies in the united states for shielding your portfolio.

At the end of the day, most of us need to save for our retirement. Gold and silver assets are Among the many most secure and most inflation-resistant items you can invest in, and can enhance any investor’s portfolio.

A gold IRA system begins Together with the interested personal opening a self-directed IRA which has a gold IRA Organization. It is very important to choose into account the evaluations and Evaluate service fees of varied companies prior to settling on where to invest.

Business logos featured on our web page are classified as the property in their respective trademark holders and listings on our web page tend not to suggest endorsement. bestgoldinvestors.com does not assert to stand for each and every offered firm, product, or provider existing out there as a whole.

Many People spend money on gold being an insurance policy versus economic uncertainties, nevertheless storage in your house poses several problems; a person remaining acquiring to acquire it with taxed profits; nevertheless, having a gold IRA you will be producing your investments without upfront tax obligations currently being payable and storage is certain and protected!

Gold IRAs are very best for investors who want diversification, are worried about inflation, and they are willing to cough up extra money for the extra service fees linked to these IRAs.

Should you Totally need to have a gold IRA, we’ve broken down the top possibilities available to you. But be sure to bear in mind that even the very best of the bunch are usually not exceptional investments for the hard-gained retirement dollars.

Dependant on our analysis, JM Bullion is the best gold IRA company. Following reviewing its services, it isn’t shocking JM Bullion is continually recognized as among the swiftest-expanding companies.

Observe: The IRS demands that precious metals satisfy purity technical specs in order to fund a specialised IRA account. When planning your investments, the agent who performs for the picked out precious metals IRA business must exclude assets that don't meet the purity standards on the IRS.

Gold ETNs (Trade-Traded Notes): Gold ETNs are personal debt devices meant to monitor the price of gold with no representing actual possession; like ETFs, these notes ordinarily aspect maturity dates and they read this article are backed by issuer’s creditworthiness – Therefore remaining acceptable inclusions into an IRA for gold traders; on the other hand, traders have to continue to be mindful of any affiliated credit score danger hazards Using these issuances.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Marcus Jordan Then & Now!

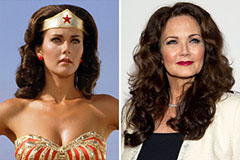

Marcus Jordan Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!